In the rapidly evolving landscape of electronics manufacturing, the decision between automated and manual IC programming equipment represents one of the most consequential investment choices facing production managers and engineering executives today. As devices become increasingly complex—with UFS 4.1 storage, high-density eMMC solutions, and sophisticated embedded systems becoming standard across automotive, consumer electronics, and medical device applications—the programming infrastructure supporting these components must evolve accordingly. This comprehensive analysis examines the return on investment considerations for IC programming equipment, providing manufacturing leaders with the data-driven framework necessary to make informed procurement decisions that directly impact bottom-line performance and competitive positioning.

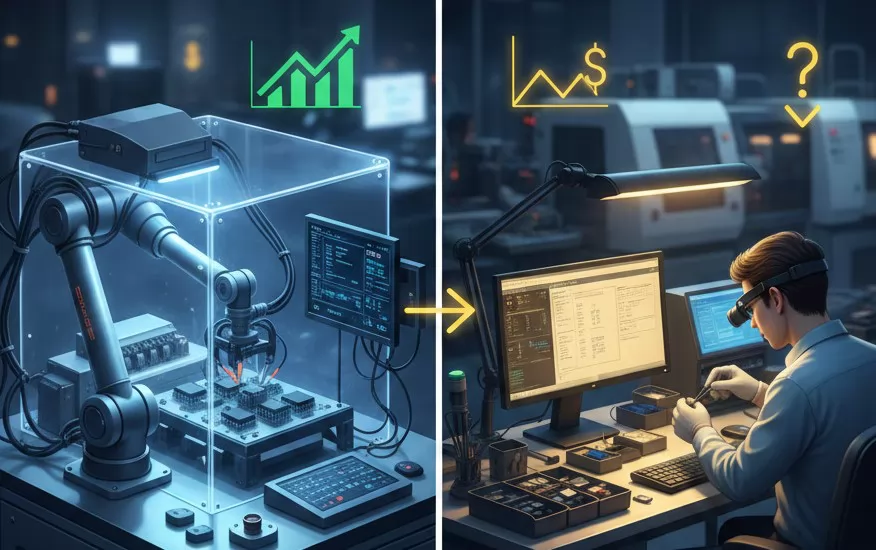

Manual IC programming, while seemingly cost-effective on the surface, harbors numerous hidden expenses that accumulate into substantial financial burdens over time. The most immediately apparent cost involves direct labor—operators required to load devices, initiate programming cycles, verify results, and manage the flow of components through the programming process. For high-density devices requiring extended programming times, this labor investment becomes particularly significant, with operators spending considerable periods waiting for programming cycles to complete rather than adding value through productive activities.

Beyond direct labor costs, manual programming introduces substantial quality-related expenses that often remain invisible until significant problems manifest. Human error in device handling, socket connection, or result interpretation leads to escaped defects that may not surface until final assembly or, worse, in the field. For applications in automotive electronics or medical devices—where component failure carries safety implications or regulatory consequences—these quality risks translate into potential liability exposure, warranty costs, and brand reputation damage that far exceed the visible programming operation costs. The rework and replacement costs associated with programming-induced defects can easily exceed the entire cost of manual programming equipment many times over, making apparent savings illusory at best.

Manual programming operations also constrain production flexibility and responsiveness in ways that create indirect but significant business costs. Changeover between device types requires operator training, socket adjustments, and process validation—activities that consume production capacity without generating output. In fast-moving consumer electronics and automotive sectors where time-to-market pressures are intense, these constraints can translate into lost opportunities and diminished competitive position. Furthermore, manual operations struggle to accommodate production volume spikes, requiring either overtime labor costs or the acceptance of delayed deliveries that may damage customer relationships and future business prospects.

| Factor | Manual Programming | Automated Programming |

|---|---|---|

| Throughput | 200-400 UPH per operator | 1,500-3,000 UPH per system |

| Labor Cost per Unit | High (ongoing wages & benefits) | Low (capital amortized over lifespan) |

| Quality Consistency | Variable (human error risk) | Consistent (automated verification) |

| Documentation & Traceability | Limited manual records | Complete digital records per unit |

| Changeover Time | Hours (training, adjustments) | Minutes (software configuration) |

| Scalability | Linear (add operators) | Flexible (batch capacity) |

| Inspection Capability | Visual only | 2D/3D automated optical inspection |

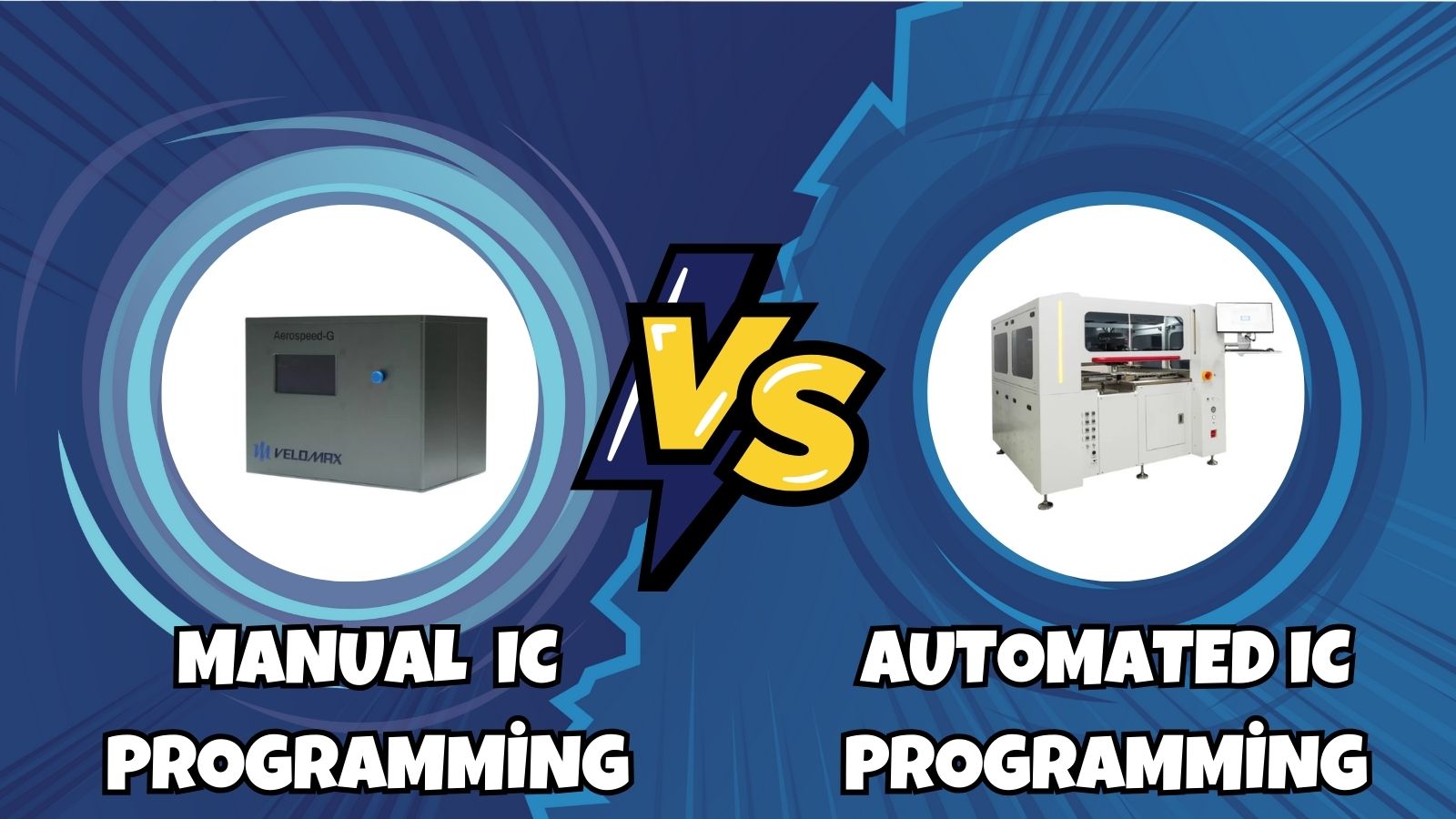

The Aerospeed-GS manual programmer from VeloMax Systems represents an excellent solution for lower-volume production environments, R&D prototyping, and applications where programming flexibility takes precedence over maximum throughput. This platform delivers fast programming performance for high-density ICs while incorporating modular automation capabilities supporting Tray, Tape, and Tube handling configurations. For organizations producing hundreds to low thousands of units monthly, the Aerospeed-GS provides an appropriate capability level without the capital commitment required for full automation. However, as production volumes grow beyond approximately 1,500 to 2,000 units daily, the economic calculus begins shifting decisively toward automated solutions.

The strategic imperative for automated IC programming investment gains additional urgency when examining market trajectory data. The automated IC programmer market is experiencing robust expansion driven by rapid advancements in semiconductor manufacturing and embedded system development, with projections indicating compound annual growth rates of 13.6% through 2033. Market analysts forecast expansion reaching approximately USD 996.67 million, reflecting the accelerating adoption of automation across electronics manufacturing sectors. This growth trajectory reflects not merely increasing production volumes but also the escalating complexity of devices requiring programming—UFS 4.1 storage, advanced eMMC solutions, and sophisticated microcontrollers demanding programming infrastructure capable of handling their requirements efficiently and reliably.

| Metric | Value | Timeframe | Implication |

|---|---|---|---|

| Market CAGR | 13.6% | 2026-2033 | Strong industry momentum favoring automation adoption |

| Market Size Growth | USD 996.67 million | By 2033 | Significant capital investment in programming infrastructure |

| UFS Programming Speed | 3,000 MB/s | Current capability | Advanced devices require high-speed programming systems |

| Industry Growth Driver | UFS 4.1, eMMC, AI chips | Ongoing | Device complexity demands capable programming equipment |

Organizations delaying automation adoption risk finding themselves at a competitive disadvantage as industry peers capture efficiency gains and establish relationships with equipment suppliers who become preferred partners for ongoing technology development. The semiconductor equipment sector's evolution toward more complex devices with higher programming data volumes makes equipment investments in capable programming systems not merely about current efficiency but about positioning for future technological requirements. Equipment capable of supporting UFS 4.1 programming—the most advanced storage specification currently entering volume production—provides assurance that capital investments will remain productive as product designs incorporate these advanced devices rather than requiring replacement equipment within short timeframes.

Calculate your potential savings by switching from manual to automated IC programming

The automotive electronics industry provides a compelling case study illustrating why automated IC programming represents not merely an efficiency opportunity but a fundamental requirement for modern vehicle manufacturing. Modern automobiles have evolved into sophisticated computing platforms on wheels, incorporating dozens of electronic control units (ECUs), advanced driver assistance systems (ADAS), infotainment systems, and electric vehicle powertrain controls—all requiring precisely programmed integrated circuits to function as intended. From engine management computers to autonomous driving processors, from battery management systems to in-vehicle networking chips, the automotive sector depends entirely upon reliably programmed semiconductors that must operate flawlessly under extreme conditions for the lifespan of the vehicle.

| Requirement Category | Specific Needs | Why Automation Matters |

|---|---|---|

| Zero-Defect Reliability | ICs must function flawlessly for 15+ years in extreme environments (-40°C to 150°C) | Automated verification ensures 100% programming accuracy without human error |

| Complete Traceability | ASPICE and IATF 16949 compliance requiring lot-to-lot tracking | Digital records link every programmed IC to manufacturing parameters and test results |

| High-Volume Production | Millions of ECUs produced annually for global vehicle platforms | Automated systems deliver consistent throughput meeting OEM volume demands |

| Advanced Device Support | UFS 3.1/4.0, high-density eMMC, secure microcontrollers for automotive grade | Flexible platforms handle diverse automotive-grade device types reliably |

| Security Programming | Secure keys, cryptographic functions, and authentication for connected vehicles | Controlled programming environments ensure secure key handling and storage |

In the high-stakes automotive industry, where programming failures can trigger billion-dollar liabilities and strict ISO 26262 compliance is mandatory, manual processes are no longer viable. As the shift toward EVs and autonomous driving demands support for complex ICs and UFS 4.1 storage, automated platforms like VeloMax have become a strategic necessity; they provide the high-speed throughput, total traceability, and zero-defect reliability essential for suppliers to qualify for Tier 1 programs and succeed in a software-defined vehicle market.

Determining the optimal timing for transitioning from manual to automated IC programming requires systematic evaluation of multiple factors that collectively indicate readiness for automation investment. Production volume represents the most immediate determinant, with the breakeven point typically falling between 1,000 and 2,000 units daily depending upon device programming complexity, labor costs, and quality requirements.

| Production Volume (Daily) | Recommended Solution | Rationale |

|---|---|---|

| < 500 units | Manual Programming (Aerospeed-GS) | Capital investment not justified; flexibility prioritized over throughput |

| 500 - 1,500 units | Aerospeed-GS or AST-1000 | Approaching automation threshold; evaluate ROI trajectory |

| 1,500 - 3,000 units | AST-1000 Automated System | Strong automation ROI; consider multi-system deployment |

| > 3,000 units | AST-9000 High-Speed Automation | Maximum throughput required; multi-unit consolidation beneficial |

VeloMax Systems brings over a decade of hardware design expertise and more than twenty years of software development experience to the IC programming equipment market, establishing a foundation of technical capability that translates into tangible customer benefits. The company's position as the first programmer supporting UFS 4.1 devices demonstrates commitment to technology leadership that keeps customers at the forefront of semiconductor capability rather than forcing them to rely upon equipment designed for previous-generation devices.

Organizations currently operating manual IC programming systems should evaluate their current operations against the criteria outlined in this analysis to determine appropriate timing for automation investment. Production volumes, device complexity, quality requirements, and growth trajectories collectively indicate whether immediate automation investment, incremental capability enhancement, or continued manual operation represents the optimal path forward. The financial analysis presented demonstrates that for production volumes exceeding approximately 1,500 units daily of complex devices, automated systems deliver compelling returns through labor reduction, quality improvement, and throughput enhancement that justify capital investment and position organizations for competitive success.

Contact the VeloMax technical team to discuss your specific application requirements and receive customized ROI analysis for your production environment.

Reach our sales team to explore our complete range of IC programming solutions, from the flexible Aerospeed-GS manual programmer to fully automated production systems supporting the most advanced semiconductor devices entering volume production today.

Discover this amazing content and share it with your network!

Your Name*

Your Email*

*We respect your confidentiality and all information are protected.